Accounts Payable automation

Do you know your accounts payable cost per invoice?

The institute of finance management (IOFM) has measured that without accounts payable automation cost are in the range of € 16 per invoice. This applies If you have no invoice automation and < 20.000 invoices processed by your team per site. This does not yet include the cost of your accounting / ERP system, the cost for physical documents like cheques and the very significant efforts outside the accounts payable team that staff and managers encounter to approve them. All this comes on top.

Do you know the additional hidden staff and management approval cost per invoice beyond the accounts payable team?

Another KPI to analyze your performance level is what percentage of your invoices is processed fully automatically without any human effort in your accounts payable department. If you are currently at below 90% you should go for a modern end to end purchasetopay solution like ebidtopay. Pure invoice automation solutions that only digitalize invoices and extract information only address the symptoms of the probleme.

You need to address the root-cause that you should only pay invoices that have a proper purchase order and that you should only work with suppliers that are reliable and strive to send you invoices that match your purchase order. Otherwise in the end you pay too much, accept maverick spend and are unable to massify your demand with those vendors that really fulfill your requirements. Check out our ROI-calculator that allows you to play with the numbers and get a concrete idea of your ROI and pay-back for investing into a modern end to end purchasetopay solution.

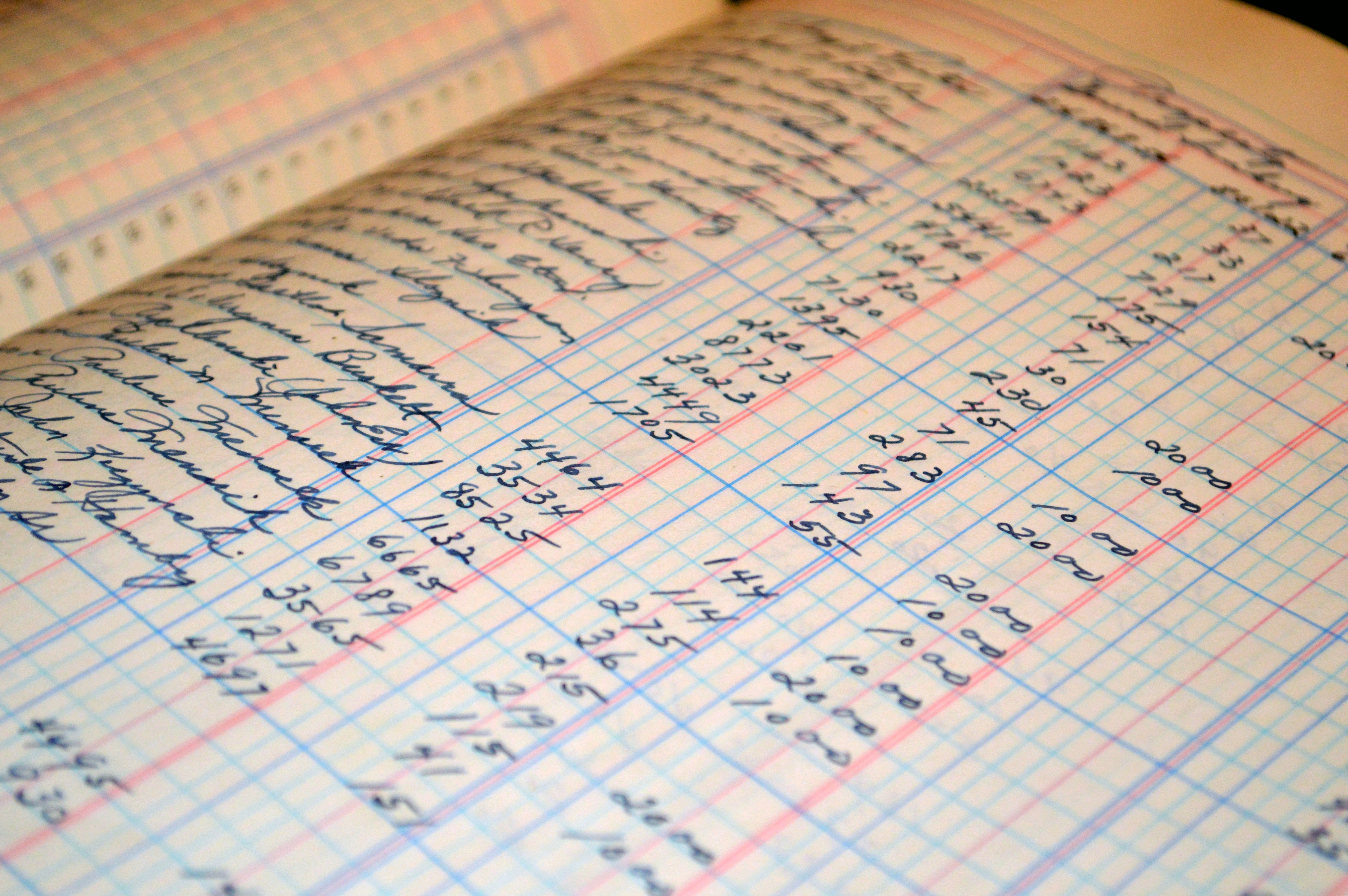

57% of companies still follow ERP style partly manual accounts payable booking which makes your company vulnerable for accounts payable fraud

Cyber crime is flourishing. If you have no system like ebidtopay in place for end to end purchasetopay invoice automation and supplier master data management the risk of fraud is increasing significantly year by year. Research by EY has shown that organizations with manual accounts payable processes make some more vulnerable for accounts payable fraud. In 2021 organizations experienced more than € 11 billion in losses due to accounts payable fraud worldwide.